According to Verified Market Research, the market for MaaS services will grow from $50 billion in 2019 to $272 billion in 2027. Shared transport services are named the cornerstones of the market and are believed to be the key to livable cities of the future. We are going to explore drivers behind shared mobility, its current implementation and prospects.

How the Sharing Economy Lands Us in a Better Today

Over the past decade, companies working under the principle of the sharing economy have changed the landscape in their industries dramatically. Shared consumption is based on the idea that it is sometimes more convenient to pay for temporary access to a product than to own it. The extensive penetration of digital technology into all spheres of our society has only boosted the rapid growth of on-demand and “anything-as-a-service” businesses.

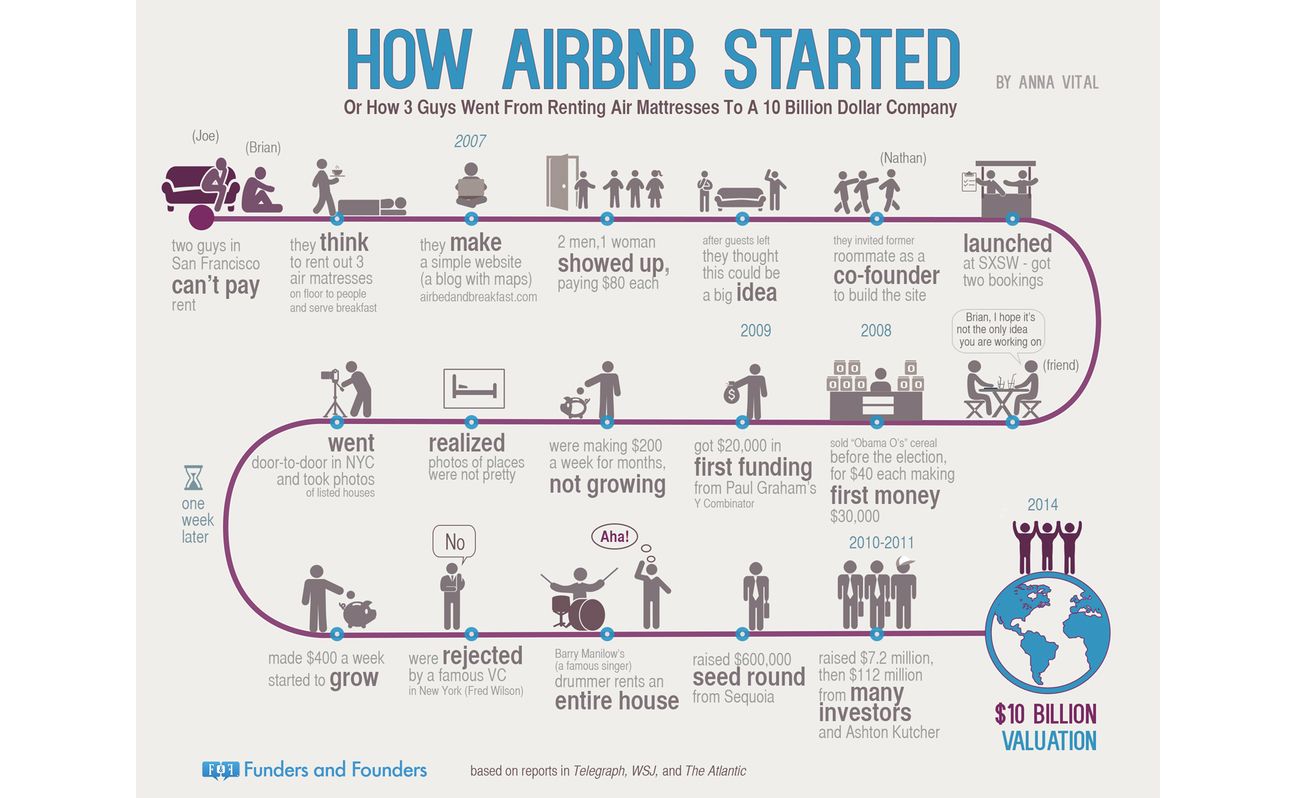

Let’s look at Airbnb, which has risen from a low-key startup to a globally recognized decacorn in 12 years. Essentially, the online marketplace with a primary focus on homestays jumped on the ideas of the sharing economy and collaborative consumption, fueled by the fact that more and more consumers prefer using services of people like themselves rather than companies. To one part of its audience, Airbnb allows earning on their property, while another part enjoys comfortable traveling coupled with affordable housing and immersion into the local atmosphere.

How AirBnB started

How AirBnB started

Source

Further, we’ve got:

- delivery services like Instacart that works based on a decentralized business model similar to Airbnb but employs part-time workers with lots of free time to pick up, pack, and deliver grocery to customers making orders online;

- peer-to-peer lending platforms, with Lending Club, Prosper, and SoFi, among others, which allow individuals to lend and borrow money outside traditional financial institutions;

- Amazon Mechanical Turk as an example of Internet-based crowdsourcing marketplaces to hire remote employees for accomplishing on-demand tasks;

- Coworking spaces lead by Impact Hub and WeWork with their magic power to cut costs on office rent and supplies, utilities, storage, and other services;

- Kickstarter and Indiegogo followed by other crowdfunding platforms, which connect startups and emerging projects to hundreds or even thousands of individuals willing to provide funds for their development;

- online marketplaces for reselling all kinds of goods, such as eBay and Craigslist, just to name a few.

We could go on reciting freelancing websites, knowledge-sharing platforms, pet boarding services, and other projects that have already changed our society and made our lives more comfortable (and sometimes more sustainable) through sharing. But what about transportation?

Say Welcome to Uberisation

The on-demand trend couldn’t fail to affect transportation, especially at the end of the 2000s when apps inspired by the sharing economy were popping up all over. So, when Garrett Camp and Travis Kalanick were caught by a cold winter night on the streets of Paris with no hope to flag a taxi, it just clicked. A few months earlier, Camp had already explored the idea of launching an app for booking a taxi via smartphones with one tap, but back then, he had believed that the business would need its own fleet.

However, Kalanick managed to convince the future partner that they can perfectly do without renting a garage, buying cars, hiring drivers, and all that crap. The idea transformed into giving drivers the opportunity to download an application and work with flexible hours as independent agents. This is how Uber started before it has morphed into a global corporation, which works in more than 10,000 cities, has almost 100 million monthly users, and is worth over $34 billion.

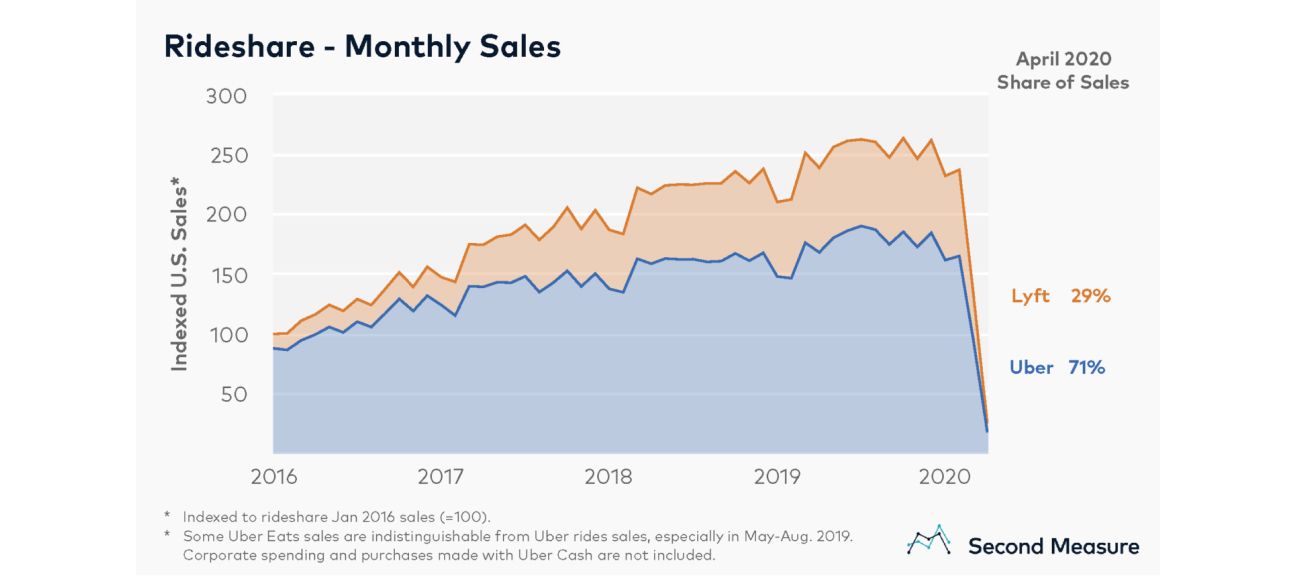

Lyft vs Uber Market Share

Lyft vs Uber Market Share

Source

Nowadays, Uber enjoys a 71% market share for ride-sharing in the USA, successfully exploiting the simple yet commercially viable idea of sharing the cost of direct transportation with other people to make it affordable and accessible. The latter aspects are universally acknowledged benefits of the sharing economy, as it provides better opportunities for people who just cannot access certain things (for example, cannot own a car) and makes using goods and services more efficient (for instance, by eliminating headaches and costs of car insurance and maintenance). Which, at last, brings us to shared mobility.

What Is Shared Mobility?

The concept covers short-term sharing various means of transportation to grant access to on-demand transportation services and bridge the gap between private vehicles and public transport.

Individual transport is seen as evil now since with the growth of privately owned vehicles, our cities are suffering from traffic jams, pollution, and noise really badly. And things are expected to get even worse, as the global population is estimated to reach 13.2 billion by 2100, and 66% of it is projected to reside in urban areas by 2050. By that time, urban distance traveled each year will triple, with the average time spent in traffic jams reaching 106 hours a year.

Most Congested World Cities Congestion Traffic

Most Congested World Cities Congestion Traffic

Source

These challenges have already initiated severe vehicle restrictions across European cities. Small old towns like Riga in Latvia or Valetta in Malta make the center completely pedestrianized to recreate the historical surroundings and attract tourists. Some large capitals are introducing congestion charges for entering the city centers — London did it back in 2003, followed by Stockholm and Milan. On a global scale, Beijing, New York, and San Francisco are working on congestion pricing.

"Green" bans have been trending since the 2010s. Motor transport is ranked according to emission standards, and the most environmentally unfriendly vehicles are banned from traveling through many cities. Cars with internal combustion engines are next in line: they are denied access to special "green zones", for example, the Ultra Low Emissions Zone in London, while Amsterdam and Paris are going to welcome only electric cars or hybrids starting from 2030.

Shared transportation is another way to go. It allows addressing the current and future urban mobility challenges with no bans and restrictions, but by offering effectiveness, flexibility, money and time-saving instead. Rather than spending the household budget on owning a means of transport and fretting over maintenance, storage/parking, insurance, and whatnot, an individual can avail of a wide choice of transportation modes available for sharing with other travelers, either simultaneously or sequentially.

Disrupting Cars

Disrupting Cars

Source

Non-transit shared modes

Strategically located, properly equipped, and connected to smart apps, shared mobility services offer a competitive alternative to both privately owned vehicles and mass transit. The following overview will give you insight into the main segments, major players, and basic trends.

- Bikesharing. Founded in 2015, Mobike, the world's largest shared bicycle platform from China, has extended its operations to 19 countries and raised its value to nearly $3 billion. Globally, the number of public-use bicycles, both traditional and e-bikes, has skyrocketed to 9.6 million, with strong predominance in Europe, China, and the Eastern Seaboard of the US.

- Scooter-sharing. During 2018-2019, this segment was demonstrating an impressive surge in downloads of apps like Lime and Bird — by 580%! However, Africa, Australia, and the Asia Pacific region are still low competition destinations.

- Carsharing. With over 200 operators currently working across the globe, Zipcar, ShareNow, EVCARD, and Yandex.Drive are among the largest ones in their respective local markets. Meanwhile, due to the pandemic, carsharing is supposed to get a bigger piece of the shared mobility cake than ridesharing.

- Rides on demand. Covering both ride-hailing and ridesharing, this segment is predictably dominated by Uber, Lyft, and DIDI, with India and China being the most promising regions to see large revenue streams in the years to come. Learn about our experience in building ride-hailing platform Gokada for Nigeria.

- Microtransit. Launched in 2017, ArrivaClick, an on-demand minibus service run by a major bus operator in the UK, offers setting pick-up and drop-off locations in an app to transfer passengers in four cities. RideCo delivers app-based microtransit services in the US, where the pandemic has caused an even greater interest in this segment.

We have deliberately slurred over some details like auto-rickshaws or vanpooling to deliver the main message — while some companies have already reaped benefits, much is left for those who will latch on to the trend.

Public transit

Metro system opening (per decade) 1860-2017

Source

Urban public transport includes all kinds of publicly owned, fixed-route transportation services, from busses and trams to ferries and subways. The biggest trend here is creating digital solutions for integration across different mass transit modes and their connection to non-transit shared modes. In addition to giants like Google Maps and Uber, we can mention Citymapper, Transit, and Moovit among popular apps that integrate data on different transportation options, including public transit, bike/car shares, etc. Other hi-tech companies try addressing narrower issues, such as UrbanThings, which receives support from the UK government and develops the Ticketless mobile platform to implement Be-in/Be-out solutions and provide cheaper and more convenient smart ticketing for public transport.

So, further development of mass transit infrastructure and its integration with other shared transportation opportunities are expected to bring multiple benefits, including:

- wider mobility choices

- reduced traffic congestion

- decreased pollution

- lower transportation costs

- improved efficiency

- implementation of last mile and first mile solutions

- equitable access to jobs and other resources

- better opportunities for those who cannot afford to own a vehicle

- higher accessibility for those with limited physical ability

But do the expected outcomes of shared mobility and the transformation of public transit resonate with travelers, transit agencies, and private operators? A study conducted by the Shared-Use Mobility Center shows that people who use shared modes are more likely to use mass transit while owning fewer cars and spending less on transportation in general. With that, shared modes mostly replace car trips than transit trips, thus complementing it and enhancing urban mobility. Moreover, public transit agencies and private operators are eager to develop their partnership to provide mobility equity, including paratransit services.

However, all the participants, along with app developers, have an even bigger aim in mind, which is MaaS.

What Is MaaS?

MaaS services, also known as mobility-on-demand or mobility-as-a-service, deliver a high-tech way of planning trips using different transportation modes. Users receive a choice of ready-made solutions on how to get from point A to point B in their smartphones, with the routes based on all available modes and traffic jams. Further, the users select the way that suits them most in terms of costs, trip time, and the level of comfort provided, book all the transportation services included in the trip, and pay for them via a single account. In the perfect world, a MaaS app should work in different cities or even countries, removing the need for a user to shift between accounts and subscriptions.

MaaS Model

Source

MaaS Model

Source

With the help of MaaS applications, city governments hope to transfer as many travelers as possible from private cars to mass transit, thereby solving the problem of congestion, pollution, and so on. On the side of consumers, they get several options for how to get to a certain place, which are tailored to their needs and personal preferences. For example, an app can offer a route with a preference for public/shared transport if it is a cheaper trip or include driving if the option is more expensive.

After all, the problem with public transport is that it does not take passengers where they need — they have to go the “last mile” on foot, and this is where they bump into the main share of discomfort as compared with a trip in a private car. But now high-tech taxi and micromobility services (bicycle and electric scooter sharing) allow building door-to-door routes with a chain of seamless transfers. All that remains is to integrate their functionality into a single MaaS application.

The main idea behind MaaS is that in the future, people won’t think much about which transportation mode to choose for getting to a destination. They will be interested in how fast they can get there and how much it will cost. MaaS services will be able to offer a faster and cheaper way of getting around than by car or taxi, making owning a vehicle a kind of hobby.

Unbelievable? Yes, not everything in the garden is rosy, but MaaS solutions are already onboard, so we can derive some experience and inspiration from these initiatives.

MaaS at Work

First, let’s sort the wheat from the chaff — not all trip planners are actually MaaS even if they provide multimodal services coupled with route and price information (like Lyft or Google). The Netherlands is a generally accepted trend-setter in MaaS, and its Institute for Transport Policy Analysis recognizes only those MaaS projects that integrate at least finding, booking, and payment of trips. Further levels of integration should include mobility packages and incentives aimed at reaching social goals (reducing the use of cars and encouraging the principles of livable cities).

One of the leading solutions that meet these requirements is Whim, a mobile application launched by Finnish MaaS Global. It is currently available in Helsinki, Vienna, the West Midlands, Grater Tokyo, and three more regions. It provides access to mass transit, taxi, car rental, ferry services, car sharing, city bikes, and e-scooters, combining routes according to many criteria, including user preferences and budget. A user can purchase a subscription or choose a pay-as-you-go option. As of 2019, Whim had 8,500 subscribers in Helsinki only and reported replacing 38% of daily car trips among MaaS users.

Unlike Whim, Swedish UbiGo operates in partnership with SL, which runs all the land-based public transport systems in Stockholm County. Car sharing, PT, and bike services can be accessed through flexible subscriptions, while rental cars and taxis with Hertz and Cabonline, respectively, can be booked in the app at a fixed price. The strong point of UbiGo is subscriptions sharable with family members or colleagues. The company started its commercial operations in Stockholm just in 2019, so it cannot boast much expansion yet.

Started as Moovel back in 2015, the project changed its name to Reach Now four years later and added BMW Group to its shareholders led by Daimler AG. The app available for iOS and Android-based devices is packed with carsharing (Share Now), taxis (Free Now), nextbike bicycle shares, E-scooters (Voi and TIER), and PT services in Hamburg and across the VRR network in Germany. Users can pay via PayPal or credit cards, and the company reported processing 16.4 million transactions in the first two quarters of 2019 only.

Here you may start wondering why the automotive giants would want to invest in something intended to reduce global demand for vehicles. Actually, major car manufacturers always try to define common patterns in the mobility industry to anticipate possible changes and even profit from riding on the wave.

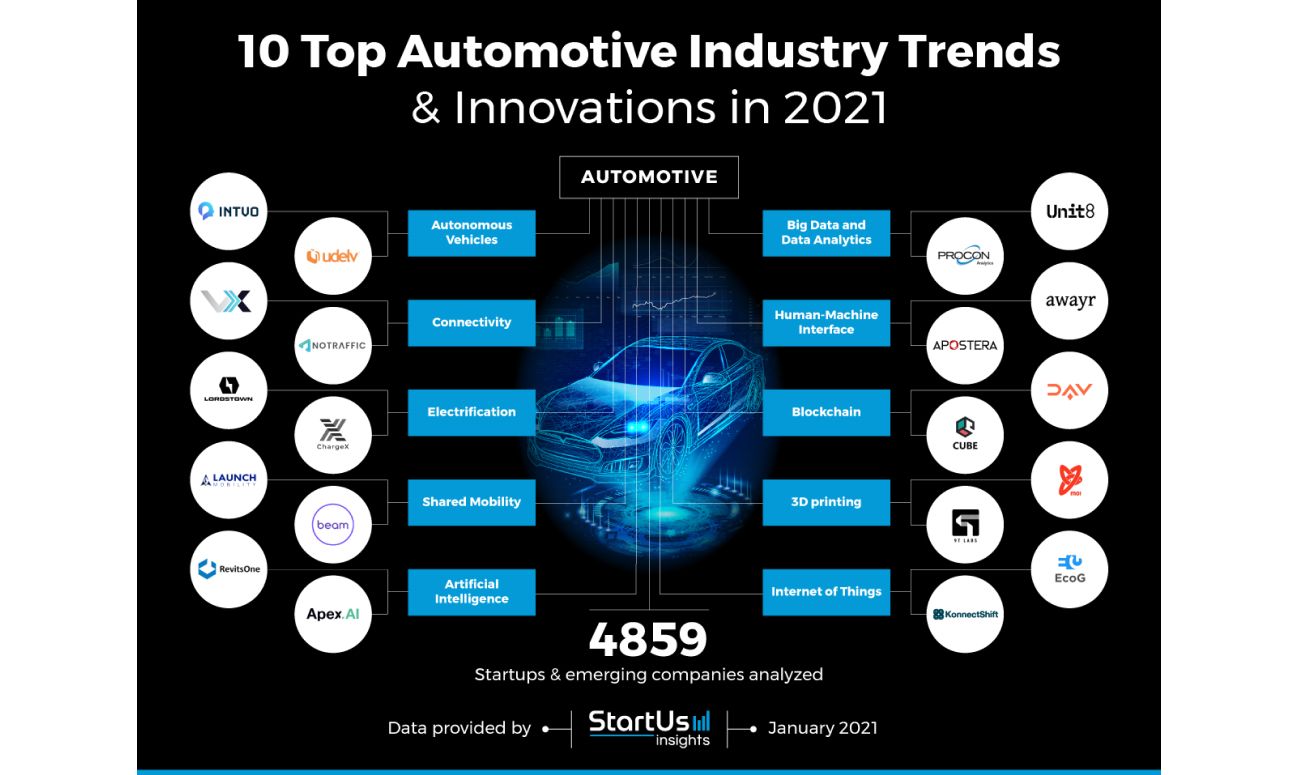

How Shared Mobility Will Change the Automotive Industry?

Automotive Startups Trend Research 2020

Automotive Startups Trend Research 2020

EVs

The Reach Now MaaS initiative is not the only collaboration in Daimler and BMW’s portfolio. The above-mentioned Share Now and Free Now are other joint ventures of the top-tier automakers in the shared mobility market. But they have one more project in place — Charge Now, which allows finding, using, and paying for electric vehicles charging online, including through a mobile app. It is not surprising taking into account that the number of electric vehicles on the roads increased from 17 thousand in 2010 to 7,2 million in 2019, according to the International Energy Agency. In 2020, Tesla alone sold 500,000 EVs, proving its status as the best-selling electric vehicle manufacturer worldwide.

Self-driving

This reminds us of Tesla’s autonomous vehicle efforts, which is another global trend in the automotive industry. As of now, Elon Musk failed to fulfill his promise to release Tesla’s full self-driving subscription in early 2021. However, Waymo, powered by Google and Alphabet and partnering with Toyota, Daimler, Chrysler, Jaguar, and Volvo, successfully launched the first-ever robotaxi in Phoenix, Arizona, and made it available to the general public in 2020. Nuro, an American autonomous delivery startup, is next on the list, having permission to operate in California, Arizona, and Texas. AutoX, a driverless robot taxi service, uses Pacifica minivans from Fiat Chrysler to transfer passengers in three Chinese cities, in addition to its RoboTruck project. In January 2021, Honda joined General Motors in the development of the Cruise Origin, which is a fully unmanned vehicle to be used for ride-hailing after testing in California. And that is by far not a complete list of self-driving vehicle startups supported by car manufacturers.

Integration

To put it all together, connected (equipped with real-time data exchange technologies) and autonomous vehicles are seen as an integral part of future shared mobility systems, especially if combined with electric power and mass transit. For example, a user will be able to book an unmanned taxi through a mobile app to take the passenger from a bus station right to the home, and then, the taxi will independently travel to the nearest station to charge its battery in a contactless mode and be ready to fulfill the next order. The International Transport Forum report Urban Mobility System Upgrade: How Shared Self-Driving Cars Could Change City Traffic explored the opportunities of a shared and self-driving fleet in a mid-sized European city and proved that it could remove at least 8 out of 10 cars, which is really impressive.

Car as a service

Moreover, coupled with the rise of interest in protecting the environment, the development of shared mobility and on-demand services have already led to a decline in global motor vehicle production. Based on Statista, it dropped from 97 million in 2018 to 78 million in 2020. Automakers respond to the challenges by introducing mobility-on-demand into their businesses. Daimler AG was among the first manufacturers to launch the car2go (currently Share Now) startup in 2008, which offered to rent Smart and Mercedes-Benz vehicles via a free app. The trend is still alive: in 2020, Hyundai Motor Group started its Mocean Carshare program for Los Angeles to give access to rental Kia and Hyundai low-emission hybrid electric cars. So, it seems that automakers are very much aware of upcoming changes and are ready to integrate into shared transportation.

The Impact of COVID-19 on MaaS Adoption

Although the pandemic prompted some new applications for shared transport like it was with microtransit travels for healthcare workers, the crisis is sure to slow down the development of MaaS, at least in the short run. Lockdowns, health concerns, and social distancing requirements have cut down the overall demand for public transit and shared modes, which are the backbone of MaaS. Multimodal transportation is also limited due to the pandemic, giving a blow to another key aspect of MaaS — the integration of multiple services. However, COVID-19 effects on the urban mobility trends illustrated below seem to open a window of opportunity for new mobility speaking medium and long term.

The further introduction of MaaS into the new normal will require plenty of homework done by governments, TSPs, and developers:

- applying health and hygiene measures across all the transportation means to create a safe environment and return the trust of travelers;

- boosting digitalization of ticketing, payment, real-time passenger information, and operations;

- developing partnership and integration models involving transit agencies and private on-demand, shared, and micromobility players;

- establishing safe, standardized, and efficient data sharing policies;

- adopting forward-looking risk management approaches.

Bottom Line

Although transport service providers, governments, and automakers are all eager to invest in shared mobility and MaaS, there is one more thing to take into account — user behavior. Along with analyzing mobility patterns in shared, autonomous, and connected urban transport, we need to encourage a shift in the mindset towards perceiving a vehicle as a service. And since traveling is not as logical as many people think, the new mobility ecosystem should be able to deliver personalized services and a perfect user experience while promoting environmental value and principles of livability.